Tether reduces $30B of commercial papers over 3 months

In the last quarter, the USDT issuer Company increased $10 billion backend reserved funds to the US Treasuries.

USDT is the biggest stablecoin asset, in terms of 24 hours trade volume globally on all crypto exchanges. USDT is enjoying a first-mover advantage in the crypto industry. Tether is the backend company behind this stablecoin, which is a subsidiary of the popular crypto exchange Bitfinex.

On 13 October, Tether announced that once again the company reduced commercial debt papers load and increased its reserve in US Treasuries.

“Tether is proud to announce that we have eliminated commercial paper from our reserves. This is evidence of our commitment to back our tokens with the most secure, liquid reserves in the market,” company said.

USDT issuer confirmed that the company reduced around $30 billion worth of commercial papers load and increased $10 Billion in the US Treasuries, only in the last 3 months of time frame.

Further Tether stated that such efforts are showing that Tether continuously reduces the chances of risks and also the company will do the same in the future to ensure the safety of the USDT users & keep back-end operations transparent to the community.

Circle (USDC) vs Tether (USDT)

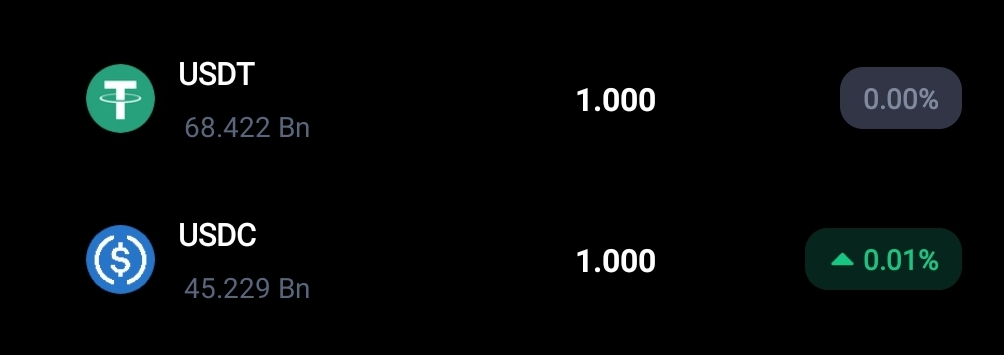

In terms of market dominance, USDC is the biggest rival of USDT. The current Market Cap of USDC is behind USDT by only $23.2 billion.

After the collapse of TerraUSD (USTC), in May during high volatility in the crypto market, USDC grabbed a better number of users.

Circle, the backend company behind USDC, showed all backed-end financial operations publicly to grab better attention. And also the USTC collapse news impacted the backend trade value of USDT. In particular, the pegged value behind each USDT plunged by around 5% but somehow the back-end team helped USDT to re-peg within a few hours.

Comments