Grape Finance Review: An Algorithmic Stablecoin Protocol Pegged to MIM

Grape Finance is an algorithm-based stable coin protocol designed to maintain a stable peg to MIM on Avalanche. It uses three token types to incentivize a stable 1:1 peg to MIM; GRAPE, WINE, and GBOND.

GRAPE’s supply is dynamically adjusted by the protocol’s underlying mechanism, driving its price up or down concerning the price of MIM. It is stated that MIM remains pegged to $1 USD. However, MIM may lose its peg occasionally. In this case, the protocol will follow MIM to maintain the 1:1 peg.

How GRAPE is Different From Other Algorithmic Protocols

Many forks are currently working on pegging to their L1 tokens to increase the amount of liquidity in the native token. Due to the rise of decentralized TVLs and smart contracts, the MIM project feels that it’s more important than ever to help increase the amount of liquidity in the stablecoin market.

The team aims to provide a more robust and stable stablecoin alternative to AVAX by pegging MIM instead of AVAX. It will allow MIM to become a more flexible and stable cross-chain alternative. Unlike MIM, GRAPE is not backed by any physical commodities. It means that it can be used as a stablecoin without locking up capital.

Grape Finance Features

Grape Finance LaunchPad

Grape Finance is working hard for partnerships with top upcoming projects on Avalanche. It aims to give WINE holders and LPs exclusive access and one-in-a-lifetime benefits.

The Grape Finance launchpad will include whitelist access, IDOs, membership rights, and amazing deals to benefit the community.

The Grape DAO also plans to build a solid community-led launchpad to bring Avalanche growth. This new adventure will build a new, unique and beneficial thing for the community. So far, they have made partnerships with Asgard and Hermes Finance that offer unique yielding opportunities for both the Grape and partner protocol.

Genesis Pools

On contract formation on Thursday, 13 January 2022, 1 GRAPE token was first generated so that the developers may build the TraderJoe LP pair (GRAPE/MIM). Because one token is insufficient to maintain any trading activity, the typical approach to establishing these protocols is to create a Genesis Pool. Here, these tokens are dispersed across the community in exchange for providing liquidity to a Genesis Pool found in the vineyard(farm).

In the first 24 hours, 2400 GRAPE tokens were released to the pool stakers. After 24 hours, the project distributed an additional nine days of pools(21600) to the remaining reward GRAPE supply. Notably, the project offered AVAX and MIM staking pools during this time. However, their weightings were substantially less than the LP pairs.

Winery(Boardroom)

WINE deposits and withdrawals into the Boardroom lock WINE for four epochs (24 hours) and GRAPE awards for two epochs (12hrs). The same happens for GRAPE rewards; this will lock staked WINE for four epochs (24 hours). Users may only claim the following GRAPE rewards after two epochs (12hrs).

Expansion

If the time-weighted average price of GRAPE is over 1.01 at the start of every epoch, new coins will be minted in the boardroom. The number of new coins distributed will depend on the current circulating supply. Notably, the first seven days after the Winery, 2.5% emissions were made for rewards.

The debt phase begins after a contraction period for expansion epochs, where there are still GBONDs to be redeemed. A portion of the expansion is allocated to the treasury fund to prepare for the bond redemption during this period.

Tokens

Grape Finance has three tokens on its platforms. The first is GRAPE a MIM pegged token. It is designed to be used as a stablecoin for exchanges, lending, and borrowing. Its algorithm aims to keep GRAPE and MIM at 1:1 for the long run.

The second one is WINE. The GRAPE token is a way to measure the value of the Grape Finance protocol and its shareholders. It is distributed to all WINE holders who have invested in the Winery.

GRAPE Bond(GBOND) helps incentivize GRAPE changes in supply during an epoch contraction period. It does this by issuing bonds when the TWAP of the token falls below 1.01 MIM. Users can redeem these bonds for GRAPE once the price is above the peg for a premium. The selling pressure on GRAPE then pushes it back toward a 1 MIM ratio.

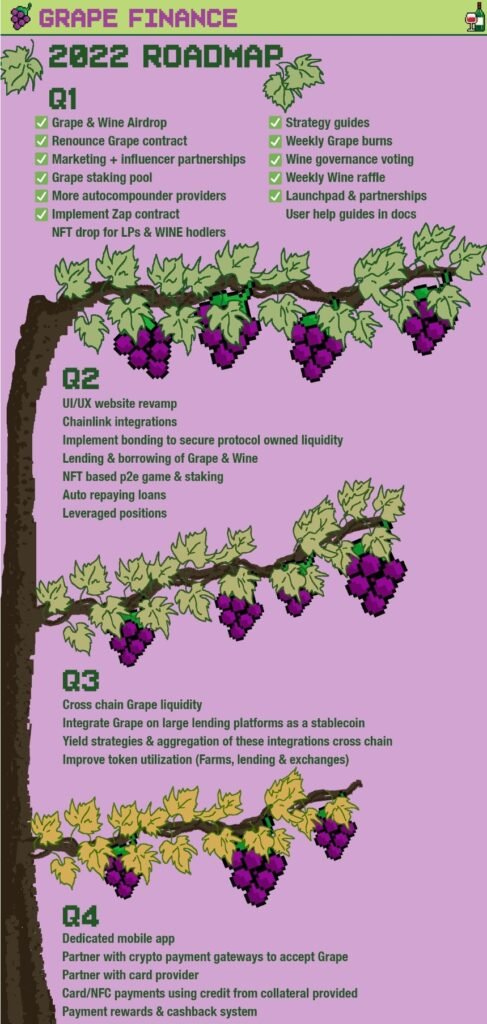

Roadmap Details: What is Next?

According to the roadmap, the first quarter is almost done. It featured grape staking, partnerships, wine governance, and raffle integration. The last remaining step is NFT drop for LPs & WINE hodlers providing exclusive access to new developments. They are currently working on launching their protocol node system, which will lock up supply, build a treasury of protocol liquidity, and let investors earn daily passive yields.

We can expect UI/UX website revamp, chainlink integrations, and lending and borrowing features in the upcoming second quarter. Furthermore, auto repaying loans, leveraged positions, and an NFT based p2e game and staking will be introduced.

In the third and fourth quarters, there are many mini-projects that Grape finance will be working on during that time. They will implement cross-chain Grape liquidity, integrate Grape to large landing platforms, yield strategies, and more partnerships. In addition, the project will create its mobile app, add card/NFC payments and payment rewards, and a cashback system.

Benefits of Grape Finance

Security

Grape Finance aims for the community to feel secure when utilizing the platform. First and foremost, the project has eliminated the need to rely on them because users can confirm everything for themselves. “Don’t trust, verify,” as the popular Bitcoin/crypto slogan goes. They have completed KYC with an independent verifier thus far.

Furthermore, they have done a comprehensive audit of the present contracts with no issues. They have resigned control of the Grape token contract, making it impossible for anyone/anything other than the Treasury contract to manufacture other Grape.

Contract Renouncing

There is a mint function in the Grape token contract by default, this can be a vulnerability if the deployer address is stolen or if a malicious team deployed these contracts. To remove this vulnerability we renounced the ownership of the Grape token contract so only the treasury contract can mint tokens, which is only possible through its programmed schedule.

Staking

Grape Finance has a Winery that allows users to stake their Wine and earn the newly minted Grape each epoch when Grape is above 1.01 TWAP. Users can also stake Grape and LP tokens into the Vineyard to earn high daily yields of Wine.

Final Thoughts

Essentially the Grape Finance team aims for GRAPE to mimic MIM as a stablecoin. However, without having to lock up collateral to create it, part of this includes adding lending and borrowing of GRAPE in the next quarter. One main issue algorithmic protocols have is sustainability. To solve this, the project adds these features on top of the base protocol to add utility to these tokens. You can find more information on the platform in the links below;

Website: https://grapefinance.app

Twitter: https://twitter.com/grape_finance

Discord: https://discord.gg/HZNUq7wKyM

Telegram: https://t.me/GrapeDefi

………………………………………………………………………..

Disclaimer: This article is not intended to be a source of investment, financial, technical, tax, or legal advice. All of this content is for informational purposes only. Readers should do their own research. The Capital is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by reliance on any information mentioned in this article.

Comments