Bitcoin may hit $150,000: JP Morgan

JP Morgan analysts predicted that Bitcoin may touch $150,000 in the long term easily.

According to a report from Bloomberg, JPMorgan, an American banking giant firm, shared its new prediction on the price of Bitcoin. This time the predicted price by JP Morgan is $150,000 per bitcoin, which is slightly higher than the last prediction.

Last year, JP Morgan predicted that Bitcoin may touch. $146,000. So we can say JP Morgan is somewhat standing at its high price target with better confidence.

Analysts noted that to touch Bitcoin to $150,000 we need to see the investment in Bitcoin just like investors of gold. That means, we need a $2.7 Trillion Market Cap in Bitcoin investment.

On 10 November 2021 Bitcoin hit a $1.3 Trillion Market Cap, so we can say that we are much closer to this targeted price to achieve because adoption is rapidly increasing and these adoptions are acting as catalysts to boost the investment in Bitcoin to grab more opportunities.

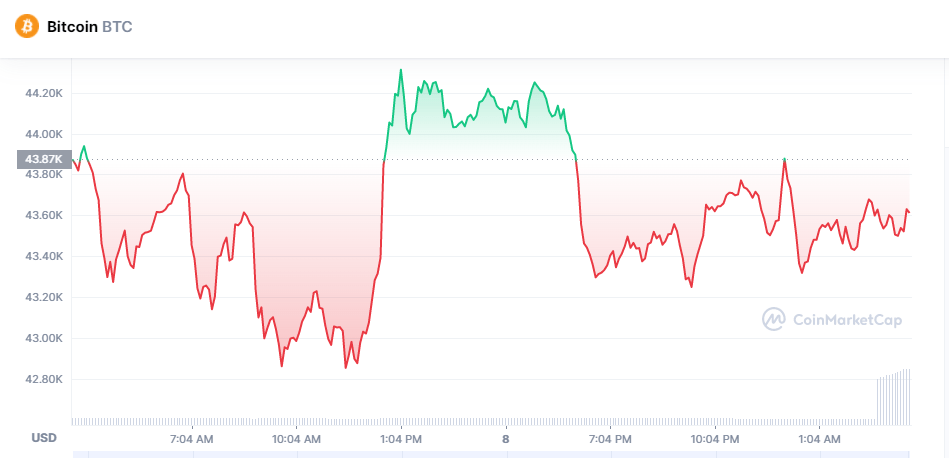

At the time of writing this article, the price of Bitcoin is $43,490 which is 0.5% low over its 24 hours trading price.

Bitcoin Adoption

On one side we are looking at the prediction of JP Morgan as a big player in the crypto industry and also many experts, who are working in the crypto industry as an analyst but here the major role to boost the adoption of Bitcoin can’t take place with small efforts.

However JP Morgan claimed that we need to see private companies’ investment in Bitcoin just like gold, but every company and financial institution in the world has no freedom as they have in US-like countries.

Last year El Salvador adopted Bitcoin as Currency. And at the beginning of the new year, El Salvador president Nayib Bukele predicted that two new countries will adopt bitcoin. If the prediction of Nayib will come true then surely no one can Stop Bitcoin to hit $150,000 this year. Because Adoption of Bitcoin by multiple countries will result in positive pressure on Companies and financial institutions to go with the Bitcoin investment.

Read also: Ukraine taking support of Bitcoin crowdfunding against Russia

Comments