JPMorgan analysts says 2022 will year of blockchain bridge

The analysis of JPMorgan predicted that 2022 will see a huge surge in blockchain bridge and tokenization of the financial Economy.

Right now we are in 2022, and we saw how NFTs grabbed a huge trend in the crypto industry to link the crypto and non-crypto sectors. But now, people are thinking that Metaverse and Web3 are the future of 2022 and 2023.

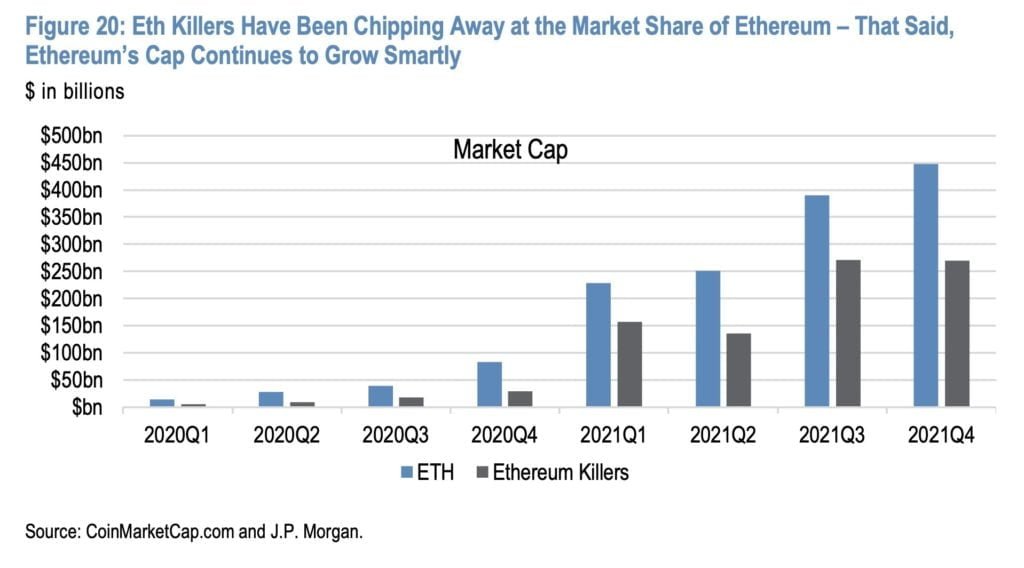

The latest analysis by the analysts of giant payment bank JPMorgan claimed that the crypto and blockchain industry will move toward the tokenization of the financial Economy and also Ethereum will lose its dominance.

Analysts’ report noted that there are many use cases with the Ethereum blockchain network in comparison to Bitcoin.

“(ETH) use cases are far more significant than what we see for bitcoin.”

But on the other side, there are better several crypto blockchain networks like Solana, Cardano, Polkadot. And these may work better. The presence of such types of blockchain networks will steal the dominance of Ethereum in this crypto market.

Further analysts asserted that Bitcoin will take the position of best store of value asset in the future because it is better in terms of many factors over gold.

“Relative to gold, we see Bitcoin is at least or more durable, portable, fungible, visible, scarce, verifiable, and free from censorship. However, Bitcoin falls short of gold in its history as a store of value”

Tokenization of financial Economy

Analysts of JPMorgan noted that tokenization of the financial assets is still in the initial phase but soon these will get better surge and adoption because of their advantageous factors.

They predicted that we will see huge numbers of tokenization of the credit, equities, parts of real estate, and non-traded investments including private equity.

Analysts noted that the majority of the traditional crypto services are giving their services as centralized services but in actual they are giving better support to the decentralized financial systems because there are working under limitations and restrictions with traditional and centralized services under the regulatory framework. And these things are an indication that the Defi industry will grow more rapidly over 2021.

Read also: Terra founder plans to bring more use cases for UST

Comments